Eileen Epstein Carney

Eileen works closely with investors in securities cases and has over a decade of experience in the legal world. She received her law degree from American University in 2005.

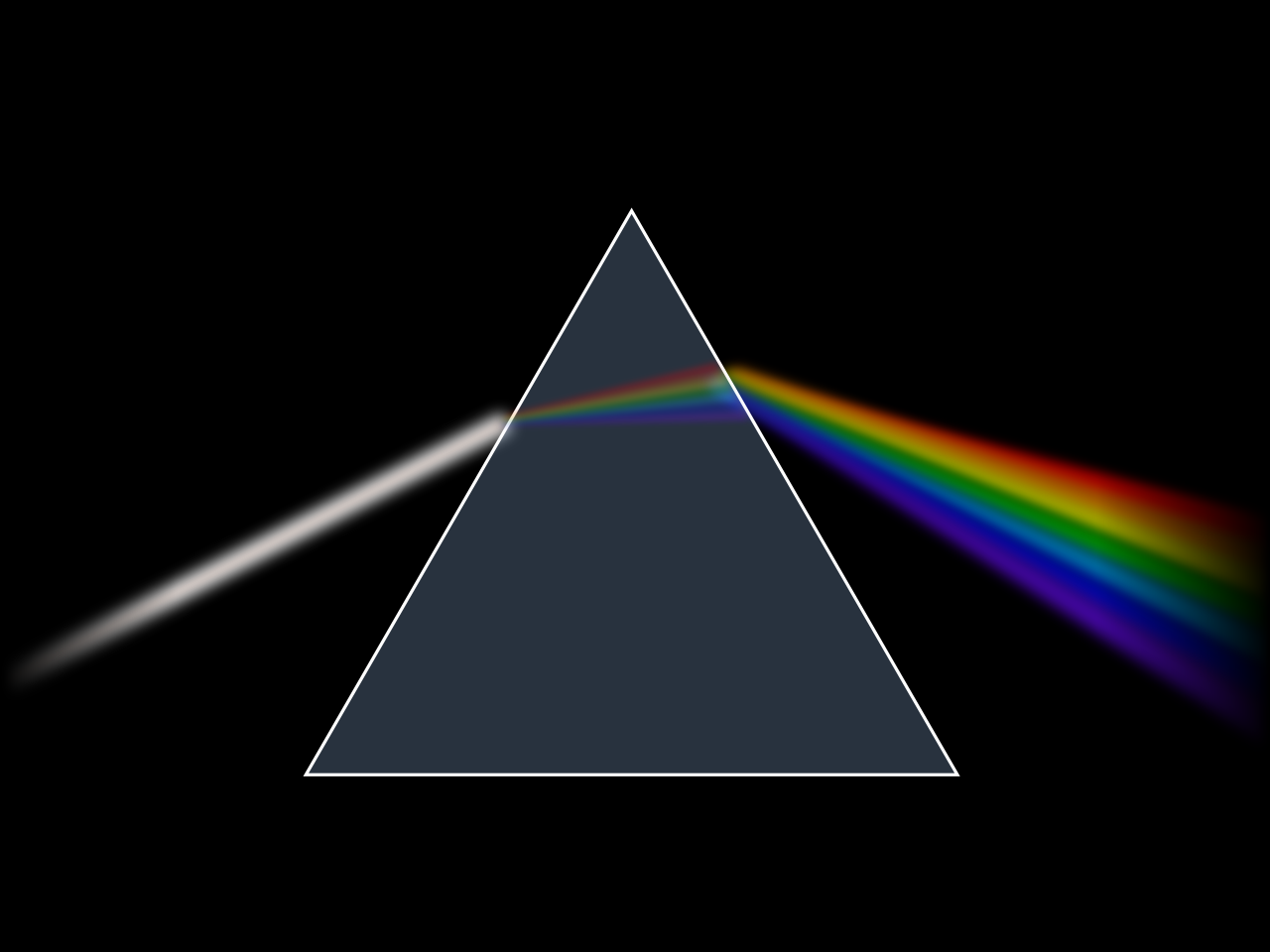

A pyramid scheme is a type of investment scam that is not sustainable in the long-run. These fraudulent business models rely on the recruitment of new investors in order to make a profit, and inevitably collapse when there are no more investors available. Past pyramid schemes have cost investors substantial amounts of money. See a list of some of the most famous pyramid schemes below.

Spot a Pyramid Scheme? Contact Us

If you believe you have identified a pyramid scheme, contact us immediately. We can help you decide next steps.

eAdGear marketed itself out as a successful internet-marketing company that could help businesses increase their visibility in search results (e.g. Google, Bing). In reality, the Securities & Exchange Commission (SEC) alleged, eAdGear did not make a large profit off of this service. Instead, most of the company’s $300 million in revenue was made from investor contributions.

According to the SEC, eAdGear recruited “Members” (investors) by promising returns of up to a “thousand dollars a day” or an annual return of “$3.6 million.” One of the main ways “Members” could earn this money was to bring in new “Members.” The SEC said that the only way eAdGear could pay investors these promised returns was through the use of new investors’ funds, a telltale sign of a pyramid scheme.

In December 2007, the SEC froze the assets of Wealth Pools International. Wealth Pools claimed to be a marketing company selling English and Spanish language DVDs through a global network of sales associates. New participants purchased a set of DVDs which they would then try to resell for profit. However, participants profited by recruiting new sales associates, and not from DVD sales. The scheme impacted as many as 70,000 people in 64 countries and cost participants $132 million in 2007 alone.

Wealth Pools is an example of a product-based pyramid scheme.

In April 2010, the owners of the Big Co-op Inc. internet shopping website were found guilty of operating a pyramid scheme in California. In this scheme, participants purchased a “license,” entitling them to commissions when they sold Big Co-op products to others, including licenses to new participants. Big Co-op claimed that profits were generated by sales of Big Co-op products and not from selling licenses to new participants. However, almost all profits made by the company came from selling licenses and from monthly dues paid by existing participants. The scheme cost over 1,000 California residents $8.2 million, and the founders each face up to 20 years in jail.

Big Co-op Inc. is an example of a product-based pyramid scheme.

In 2007, a federal appeals court in Texas confirmed a two-year sentence for Harvey Joseph Dockstader Jr. Dockstader operated a pyramid scheme called Elite Activity which recruited participants to take part in a “cycle of abundance.” In the scheme, participants contributed an initial monetary “gift” and were promised substantial profits as they recruited new participants. Dockstader convinced participants to join by claiming that his program was inspired by God.

Elite Activity is an example of a naked pyramid scheme.

In common usage, people often refer to anything they deem a scam as a “pyramid scheme.” For example, people have referred to various multi-level marketing operations as “pyramid schemes,” but the technical definition requires a pyramid scheme to involve financial fraud.

Many also often confuse Ponzi schemes with pyramid schemes. To learn more about the difference between these two scams, visit our Ponzi Scheme vs. Pyramid Scheme page.

Eileen works closely with investors in securities cases and has over a decade of experience in the legal world. She received her law degree from American University in 2005.

David’s advocacy has generated major recoveries for consumers impacted by financial fraud. He was named to the Top 40 Under 40 by Daily Journal and a “Rising Star in Class Actions” by Law360.

Amanda is spearheading a securities lawsuit against NantHealth concerning fraudulent statements to investors about the success of its key product.