California Paystub Law (2026)

You can recover penalties if your employer refuses to give paystubs

A paystub is a breakdown of an employee’s earnings in a pay period. Although federal labor law does not require employers to provide pay stubs to employees, California paystub law requires employers give an “itemized wage statement” or paystub for each pay period (a standard pay period is 2 weeks).

What if your employer refuses to give pay stubs? There are penalties for employers not giving paystubs:

Penalties for Not Giving Paystubs

In California, an employer that refuses to give paystubs to an employee may incur a civil penalty of $50 for the first pay period in which no paystub was provided, and $100 in each pay period after that, up to a maximum of $4,000 per employee. California employment law empowers employees to collect labor penalties on behalf of the State of California, including for violations of California paystub law.

More on Paystub Law

| 9 Major Paystub Requirements | Can employer require direct deposit? |

| How to request payroll records | Electronic Paystub Requirements |

| Paystubs and Under-the-Table Pay | Overtime on Paystubs |

Your employer not giving paystubs?

If your employer refuses to provide you with paystubs as required under California labor law, you may be eligible to recover penalties. Contact us for a free consultation.

California Paystub Requirements (2023)

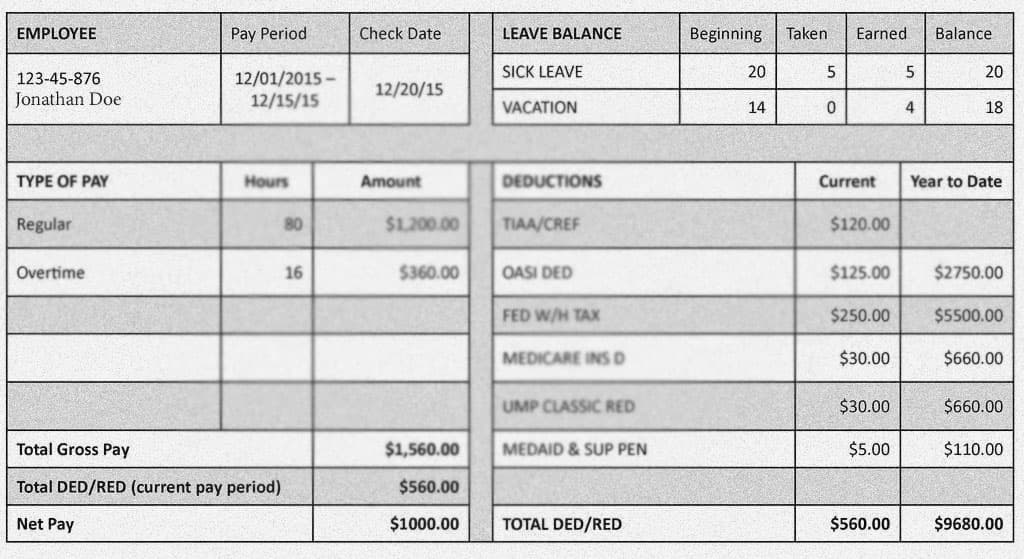

California labor law requires that paystubs be itemized, and include the following information:

- Employee name and last four digits of Social Security Number (SSN) or Employee ID Number (EIN)

- What pay period the paystub is for

- Gross wages (without deductions) for the pay period

- Total hours worked by the employee

- Breakdown of regular vs. overtime hours

- All deductions (tax withholdings, 401(k) contributions)

- Net wages earned (gross wages minus deductions)

- Name and address of the employer

- Amount of sick leave and vacation the employee has accrued.

Can an employer require direct deposit in California?

Under California Labor Code section 213, employers cannot require an employee to receive payment of wages by direct deposit.

A California employer can pay an employee by direct deposit only if the employee expressly consents. Otherwise, the employer must deliver paper checks or some other permitted form of payment of wages.

Requesting Your Payroll Records

Employers are required by California labor law to maintain copies of all employees’ paystubs for a period of up to three years.

If an employee requests payroll records, the California labor code requires employers to provide the requested records within 21 days. If the employer refuses to give paystub records, or provides them untimely (later than 21 days), the employee can collect California labor code penalties.

No paystub = you can recover penalties

Digital Paystubs

The California paystub-law statute, California Labor Code Section 226, does not discuss the requirements for digital or electronic paystubs. But the California Department of Labor Standards Enforcement has issued some guidance concerning the content of electronic paystubs and employees’ access to them:

- All electronic wage statements must include the same information required for paper paystubs;

- Employers are required to maintain copies of digital paystubs for up to 3 years, just as with paper records;

- Employers must allow employees the option of receiving paper paystubs instead of electronic ones;

- Digital paystubs must be made accessible to employees at all times on a payroll website;

- Employee access to the website must be free;

- The website must be secured by a firewall and employee login requirements.

Are electronic paystubs for direct deposit allowed?

Itemized wage statements may be provided digitally, or on paper in a separate document, or as a detachable portion of the paycheck. Not only employees who receive paper checks, but also employees who receive paychecks through direct deposit, are entitled to receive paystubs from employers every pay period.

Under-the-Table Pay in Cash

Employers sometimes offer to pay employees cash under the table. This means the employer does not deduct payroll taxes from the employee’s wages. The California Employment Development Department, however, warns that it’s illegal to pay an employee under the table, and it may harm the employee by subjecting them to tax audits. If an audit occurs, the California Employment Development Department says, employees paid under the table will be in big trouble because they won’t have paystubs or W-2’s to verify their earnings.

Overtime on Paystubs

California overtime law requires that employees get overtime wages any time they work more than 8 hours a day or 40 hours a week.

California labor law requires employers to properly record, on a paystub, any overtime hours an employee has worked and the dates on which the overtime occurred. If an employer refuses to give an employee a paystub listing their overtime hours, it is considered a violation of the California labor code. Employees may be able to recover a penalty of $50 for the first refusal to give a paystub, and $100 for every subsequent refusal, up to a maximum of $4,000 in penalties per employee.

Our California Paystub Lawyers

Steven Tindall

Steven specializes in employment litigation and has been lead or co-lead counsel on several cases that resulted in settlements of over $1 million.

View full profileLinda Lam

Linda has recovered millions of dollars prosecuting fraud, breach of contract, and breach of fiduciary cases against large banks and insurance companies.

View full profileSteve Lopez

Steve litigates a wide range of complex cases, from environmental mass torts to consumer class actions. He has secured over $1 billion for his clients.

View full profileOur California Employment Practice

About Us

No paystubs? You may be entitled to substantial penalties

If none of the employees at your company are given paystubs, you may be entitled to recover penalties on their behalf. Contact us for a free consultation. No obligation. Conversations are confidential.