TurboTax Class Action Lawsuit

TurboTax hides free-file option from poorest taxpayers, lawsuit says

Our firm has filed the first Turbotax class action lawsuit accusing the company of tricking low-income taxpayers, who were entitled to file their taxes with TurboTax for free, into paying up to $200 to file.

The Turbotax class action alleges that the company has a version of its online tax software, “TurboTax Freedom,” which it is required to offer to poor taxpayers for free, based on an agreement with the IRS. TurboTax hid this version of its software, while advertising a “Free Edition,” which didn’t end up being free, according to the complaint.

Read the “Free” TurboTax class action lawsuit complaint. Or read about our military class action against TurboTax.

Paid for TurboTax when you thought it would be free?

Fill out the form for a free consultation with an attorney.

Class Action Lawsuit: TurboTax Hides Free-To-File Services, Tricks Customers Into Paying

TurboTax is an online tax filing service used by millions of customers every year to electronically file their taxes. Based on an agreement with the IRS, any taxpayer whose adjusted gross income is $66,000 or less is eligible to use online tax preparation software to prepare and file their tax returns for free for the 2018 tax season.

Our class action lawsuit alleges that TurboTax violated its agreement with the IRS by intentionally driving customers away from its free software, altering its website to hide the free filing option from search engines, and advertising a service that would not be free as a “guaranteed” no-cost option. Many Americans who would have qualified for the IRS free-filing programs, were instead forced to pay filing, software, and even late fees on certain occasions, according to the complaint.

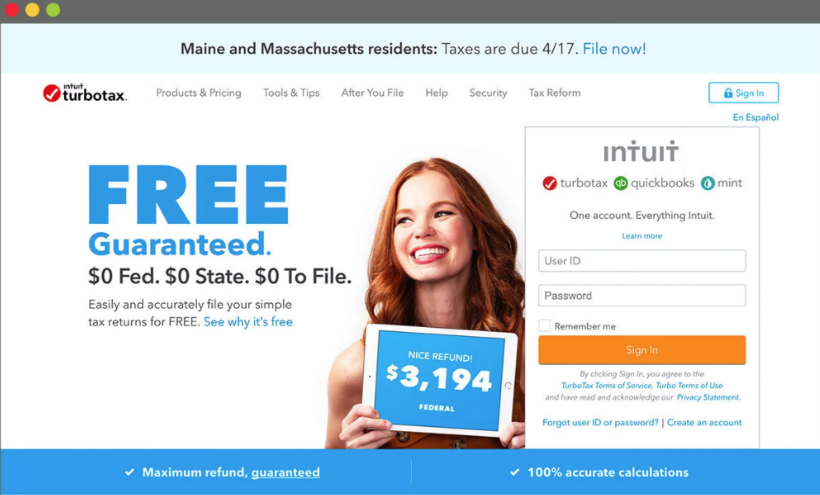

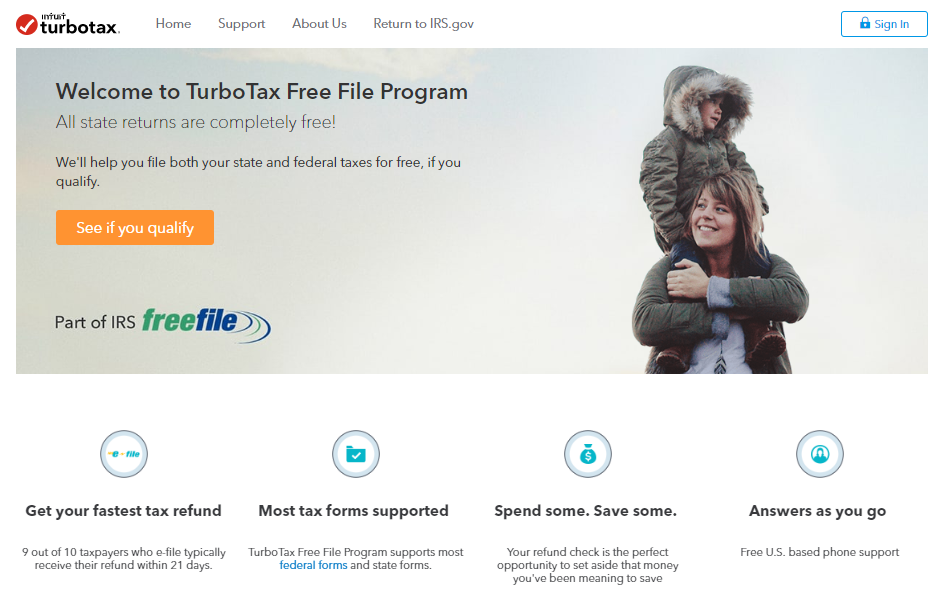

Turbotax “Free Edition”

TurboTax “Freedom” Edition (Free File Program)

Turbo Tax Class Action Lawsuit Update: Court Denies Motion to Compel Arbitration

On March 12, 2020, the Court denied Intuit’s Motion to Compel Arbitration. In its order, the Court found that the TurboTax Terms of Use did not force customers to give up their right to sue in court. The Court agreed with our arguments that the hyperlinks to the Terms of Use were too inconspicuous and confusing, particularly where less than 0.55% of users actually clicked on the Terms. According to the order,

Because the Terms were too inconspicuous to give Plaintiffs constructive notice that they were agreeing to be bound by the arbitration agreement when they signed in to TurboTax, the Court finds that Plaintiffs did not agree to the arbitration provision.

Based on this ruling, claims on behalf of consumers in the TurboTax Class Action Lawsuit will now be allowed to proceed before one judge in federal court, rather than in confidential, binding arbitrations. Intuit has already appealed the Court’s Order. Despite the appeal—which will likely be a lengthy process—the Court said that it will allow the case to proceed on our challenge to Intuit’s practices, and the Court ordered the parties to propose a schedule for presenting legal arguments.

CA Government Official Files TurboTax Free File Lawsuit

The Los Angeles City Attorney filed a lawsuit against Intuit, the maker of TurboTax, stating that “Intuit has for years

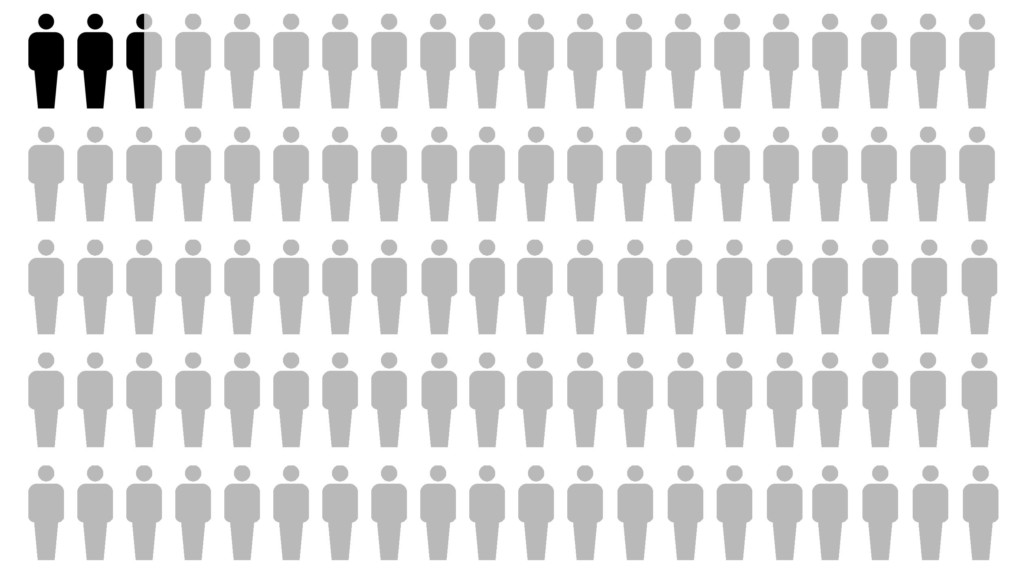

defrauded the lowest earning 70 percent of American taxpayers—who are entitled under a private industry agreement with the IRS to file their taxes online for free.” The lawsuit complaint accuses Intuit of “actively undermining public access to the IRS’s ‘Free File’ program.” The complaint points out that while 100 million taxpayers were eligible to file for free under the IRS Free File Program, only 2.5 million taxpayers used the program. The TurboTax lawsuit is filed on behalf of the people of California and says that the “abysmal participation rate” in the IRS Free File Program is partly attributable to TurboTax “aggressively marketing as ‘Free’ an inferior, watered-down version of their software that is useless to all but those with the simplest of tax returns.”

Only 2.5 in every 100 eligible taxpayers used IRS Free File Program

Our Consumer Protection Attorneys

Eric Gibbs

A founding partner at the firm, Eric has negotiated groundbreaking settlements that favorably shaped laws and resulted in business practice reforms.

View full profileAndre Mura

Andre represents plaintiffs in class actions and mass torts, including in the areas of consumer protection, privacy, and products liability.

View full profileAaron Blumenthal

Aaron represents consumers, employees, and whistleblowers in class actions and other complex litigation.

View full profile